Managing multiple entities is a sign of growth—but it can also become a financial headache. Between juggling different currencies, compliance rules, intercompany transactions, and reporting structures, CFOs are under immense pressure to keep everything accurate and timely.

That’s where multi-entity financial management with Sage Intacct and Sage 300 makes a real difference. Whether your business operates globally, nationally, or across franchises, these two ERP solutions offer automation, visibility, and control that traditional accounting software just can’t deliver.

Let’s break down how both Sage platforms simplify the complex world of multi-entity operations.

The Challenge: Why Multi-Entity Management Is So Complex

Managing a single company’s books is one thing. Add another branch, region, or subsidiary—and everything changes. You now have to deal with:

- Multiple charts of accounts

- Currency conversions and exchange rates

- Intercompany eliminations and reconciliations

- Varying tax and compliance requirements

- Different approval workflows and user roles

Without the right ERP solution, finance teams often resort to manual workarounds, disconnected spreadsheets, or siloed systems. These quick fixes create more room for error—and slow down strategic decisions.

Why Sage Intacct Stands Out for Multi-Entity Financial Management

Sage Intacct, a cloud-native ERP solution, is designed with multi-entity organizations in mind. It’s ideal for fast-growing businesses that want to automate their operations and consolidate financial data in real time.

Here’s what sets Sage Intacct apart:

1. Centralized Multi-Entity Architecture

Sage Intacct allows you to manage all your entities from one place—no need to log in and out of separate databases. Whether you’re operating 2 or 200 entities, you get:

- A shared chart of accounts (or separate ones, if needed)

- Configurable role-based access by entity

- Easy intercompany transaction automation

- Centralized AP and AR with entity-specific visibility

It’s built for flexibility, so you can scale without breaking your processes.

2. Real-Time Consolidated Reporting

Tired of waiting until month-end to see the full financial picture?

Sage Intacct gives CFOs real-time dashboards and consolidated reports with just a few clicks. You can filter by entity, location, department, or even project. Consolidations are performed automatically, including:

- Currency conversions

- Elimination entries

- Intercompany balances

This means you’ll spend less time on spreadsheets and more time on strategy.

3. Automated Intercompany Transactions

Intercompany billing can be a logistical nightmare. With Sage Intacct, it’s seamless. The platform automatically:

- Creates due-to/due-from journal entries

- Applies rules for markups or allocations

- Handles recurring intercompany transactions

- Syncs payments across entities

Say goodbye to double data entry and reconciliation errors.

4. Multi-Currency and Global Compliance

Where Sage 300 Fits: On-Premise Control for Complex Organizations

While Sage Intacct shines in cloud environments, Sage 300 is still the go-to solution for companies that prefer on-premise setups or hybrid infrastructure.

Sage 300 helps manage multi-entity structures through:

- Robust financial modules: General Ledger, AP/AR, inventory, and cash management

- Customizable reporting: With tools like Financial Reporter and Intelligence Reporting

- Intercompany integration: Centralized processing with optional entity-specific logic

- Flexible deployment :Ideal for firms needing on-prem control or integration with legacy systems

It’s especially popular in industries like manufacturing, distribution, and construction.

Real Benefits for Multi-Entity CFOs

When you streamline multi-entity financial management with Sage Intacct or Sage 300, your finance team will benefit in several ways:

- Time Savings: Close books faster with automated reconciliations and consolidated reports

- Accuracy: Reduce human error through built-in workflows and validation rules

- Visibility: Make confident decisions based on real-time, entity-level data

- Compliance: Ensure internal controls are in place across subsidiaries

- Scalability: Add new entities, users, or locations without overhauling systems

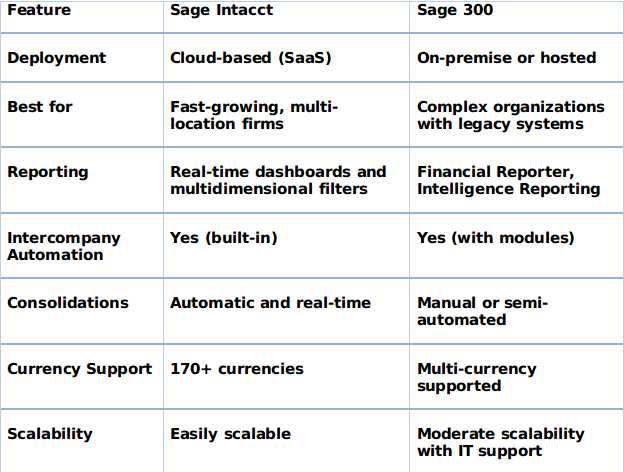

Quick Comparison: Sage Intacct vs. Sage 300 for Multi-Entity Management

Why Microsys?

At Microsys, we specialize in helping mid-sized and enterprise businesses transform their financial operations. As a trusted Sage Consultant in Toronto, Markham, and across Ontario, we bring deep experience in multi-entity implementation, data migration, and system integration.

Whether you choose between Sage Intacct or Sage 300, our team helps ensure you get the most from your investment—with minimal disruption and maximum ROI.

Let’s Talk About Streamlining Your Entities

Ready to simplify complex financial structures?

Microsys is here to help you leverage multi-entity financial management with Sage Intacct or Sage 300. Our experts will assess your current systems, walk you through the right ERP options, and deliver a solution tailored to your business model.

Reach out to Microsys today and let’s make your next financial close faster, smarter, and stress-free.