Sage Intacct is a cloud-based accounting software that offers businesses of all sizes real-time financial insights, automated financial management processes, and customizable reporting options. With Sage Intacct, businesses can easily manage their finances, streamline their workflows, and make better-informed financial decisions.

Despite its many benefits, many users are still not taking full advantage of Sage Intacct’s advanced features. This could be because they are not aware of these features or are not sure how to use them. This is where this blog comes in.

As trusted Sage consultants, we help you take your Sage Intacct experience to the next level by providing advanced tips, customization strategies, and integration techniques. We will also share best practices to help you make the most of your Sage Intacct investment and maximize your team’s productivity.

Understanding Sage Intacct: Industry-Leading Cloud Finance Software for Growing Businesses

Sage Intacct isn’t just another accounting software; it’s a cloud-based financial management platform designed to propel your business forward. Built specifically for growing companies, Sage Intacct offers a robust suite of features that streamline processes, improve visibility, and empower finance leaders to make strategic decisions.

Imagine closing your books up to 79% faster. Sage Intacct makes this a reality with automated workflows, efficient data entry, and real-time reporting capabilities. This translates to less time spent on mundane tasks and more time spent on strategic analysis and driving growth initiatives.

Gain a clear picture of your financial health across your entire organization with real-time insights from consolidated entities. This allows you to make informed decisions based on the latest data, identify trends, and seize opportunities as they arise.

Recommended Read: How Sage Intacct Streamlines Financial Operations for SMBs

True Cloud Flexibility and Accessibility for the Modern Business

With its robust infrastructure handling over 100 million application requests daily, billions of API calls monthly, and managing over 50 billion financial records, Sage Intacct ensures scalability and reliability for businesses of all sizes. Plus, its intuitive interface simplifies adoption across your entire organization—regardless of location.

Quantifiable Benefits: High ROI and Customer Satisfaction

Sage Intacct delivers a significant return on investment (ROI), with customers experiencing an average of 250% ROI and payback periods of less than six months. This translates to real financial benefits that can be reinvested into further growth initiatives.

Furthermore, Sage Intacct consistently ranks high in customer satisfaction. They have been recognized as the No. 1 in Customer Satisfaction by G2 for eight consecutive years, highlighting their commitment to user experience and ongoing support. Additionally, Trust Radius has recognized Sage Intacct as a top-rated ERP solution, solidifying its position as a leader in the cloud finance space.

Key Features of Sage Intacct:

To delve deeper into the capabilities of Sage Intacct, let’s explore its core features across five key categories:

- Core Financials: Streamline core accounting processes like accounts payable, accounts receivable, general ledger, and cash management. Enjoy a centralized platform with real-time data for complete financial transparency.

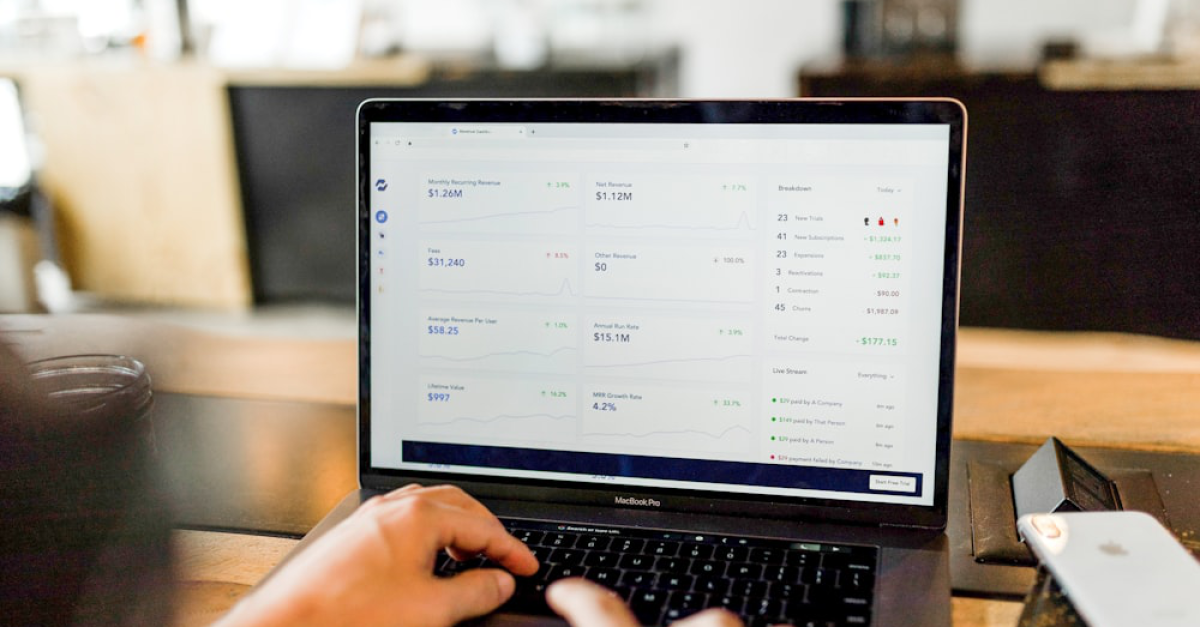

- Dashboards and Reporting: Customize dashboards to visualize key performance indicators (KPIs) and gain real-time insights into your financial health. Generate insightful reports with drill-down capabilities for in-depth analysis.

- Billing: Manage the entire billing lifecycle with ease, from creating invoices and managing subscriptions to automating recurring payments.

- Advanced Functionality: Discover the power of advanced features like multi-entity consolidation, project accounting, budgeting, and forecasting. Gain deeper insights and make data-driven decisions for your business.

- Platform: Connect Sage Intacct with your existing ecosystem through its open API. Integrate with best-in-class solutions across different departments for a truly connected and efficient business environment.

Tip#1 Leveraging Automation for Effortless Efficiency in Sage Intacct

Sage Intacct provides a robust automation suite that can significantly reduce manual tasks, improve data accuracy, and free up valuable time for strategic financial analysis.

Here are some of the key automation features in Sage Intacct and how they can benefit your business:

1.Scheduled Reports:

Say goodbye to manually generating reports every month or quarter. Sage Intacct allows you to schedule automatic report generation at defined intervals. This feature is incredibly useful for frequently needed reports like monthly sales reports, cash flow statements, or accounts payable aging reports.

Here’s how to set up scheduled reports:

- Navigate to the Reports section within Sage Intacct.

- Select the desired report template.

- Choose the scheduling options, including preferred delivery frequency (e.g., daily, weekly, monthly) and delivery method (e.g., email, download).

- Specify the recipients for the generated report.

Example: Imagine you need a monthly sales report by the 5th day of each month. You can schedule the “Sales by Customer” report to run automatically on the 1st of each month and deliver it to your inbox and the sales manager’s email.

2.Automatic Bank Reconciliation:

Reconciling bank statements can be a tedious and error-prone process. Sage Intacct’s automatic bank reconciliation streamlines this process by allowing you to upload bank statements directly into the system. The system then automatically matches transactions with existing entries in your accounts payable or accounts receivable, significantly reducing manual work and reconciliation time.

Here’s how to set up automatic bank reconciliation:

- Download your bank statement in a supported format (e.g., CSV, QIF).

- Within Sage Intacct, navigate to the Bank Reconciliation module.

- Upload the downloaded bank statement file.

- The system will automatically match transactions based on pre-defined rules. You can then review and approve the matched transactions.

Recommended Read: SIMPLIFY YOUR WORKFLOW: Implementing Sage Intacct With Your Business Ecosystem

3.Recurring Journal Entries:

Recurring transactions like rent payments, salary payments, or loan repayments are prime candidates for automation. Sage Intacct allows you to set up recurring journal entries, eliminating the need for manual data entry every month or quarter.

Here’s how to set up recurring journal entries:

- Navigate to the General Ledger module within Sage Intacct.

- Select “New Journal Entry.”

- Enter the transaction details, including accounts, amounts, and descriptions.

- Choose the “Recurring” option and define the desired recurrence frequency (e.g., monthly, quarterly, annually).

It could also help ensure your company pays rent on the 1st of every month. Setting up a recurring journal entry for rent ensures the automatic generation of the journal entry each month, eliminating the risk of missed payments or late fees.

Tip#2 Customizing Intacct to Your Business Needs

Out-of-the-box financial software is a great starting point, but every business has unique needs and workflows. A “one-size-fits-all” approach can leave you struggling to capture essential data, generate insightful reports, or manage complex processes.

Sage Intacct breaks free from these limitations with robust customization options. You can adapt the software to perfectly align with your business needs, leading to:

- Enhanced data capture:Add custom fields to capture data points specific to your industry or operations (e.g., project codes, department-specific cost centers, product variations).

- Streamlined workflows:Automate tasks and processes based on your needs, saving time and minimizing errors.

- Actionable insights:Design custom dashboards with key performance indicators (KPIs) relevant to your business and generate reports tailored to your decision-making needs.

Exploring Customization Options:

Sage Intacct offers a variety of customization options to empower control over your financial data:

1.Custom Fields:

Don’t let pre-defined fields limit your data capture. With custom fields, you can extend the functionality of Sage Intacct to capture information critical to your business. For example:

- A marketing agency can add a custom field to track campaign performance data.

- A manufacturing company can add custom fields to capture product serial numbers or lot codes.

- A retail store chain can add custom fields to track sales by department or product category.

2.Dashboards and Reports:

Move beyond generic reports. Sage Intacct allows you to create custom dashboards with the KPIs that matter most to your business. These dashboards can be personalized for different user roles, ensuring everyone has quick access to the information they need. Additionally, you can customize reports with preferred layouts, filters, and drill-down capabilities to gain deeper insights into specific areas of your financial data.

3.User Access Levels:

Maintain data security and control user permissions by setting different access levels. You can restrict access to sensitive financial data based on user roles and responsibilities. For example, entry-level accounting staff may only have access to accounts payable functions, while senior management may have access to all financial data.

Tip#3 Optimizing Approvals for Seamless Workflows

Inefficient approval processes can create bottlenecks and slow down financial operations. Sage Intacct empowers you to streamline approvals with customizable workflows. Here’s how:

- Set Up Approval Rules: Define criteria triggering approvals, such as transaction amount exceeding a set limit.

- Department of Project-Based Approvals: Assign approvals based on departments or projects involved for targeted control.

- Email Notifications: Keep approvers informed with automatic email notifications, ensuring a smooth and timely approval process.

- Multi-Level Approvals: For complex scenarios, configure multi-level approvals for hierarchical approval structures.

By optimizing approvals, you prevent delays, ensure proper authorization, and maintain control over your finances.

Tip#4 Favorites and Bookmarks: Find What You Need Fast

Don’t waste time searching for frequently used functions or reports! Sage Intacct’s Favorites and Bookmarks feature lets you create a personalized list for quick access. Simply star your favourite reports or functionalities, and they’ll be readily available at your fingertips. This intuitive feature streamlines navigation and saves valuable time, allowing you to focus on what matters most – analyzing data and driving business growth.

Tip#5 Harnessing Smart Rules for Enhanced Control

Sage Intacct’s Smart Rules are powerful tools for data validation, enhanced reporting, and workflow automation. These rules operate on “if-then” logic based on predefined criteria. For example, an “if” statement like “if the purchase order amount exceeds $5,000,” followed by a “then” action like “send notification for approval.”

Applications of Smart Rules:

- Data Validation: Ensure data integrity by flagging transactions exceeding budget limits, missing required fields (e.g., customer name), or violating pre-defined business rules (e.g., preventing negative inventory balances).

- Enhanced Reporting: Streamline reporting by automatically categorizing transactions based on criteria (e.g., project code) or populating custom fields with relevant data for easier analysis.

- Improved Workflows: Automate tasks and notifications. Trigger alerts for approvals exceeding a certain amount, send reminders for overdue invoices, or initiate specific workflows based on custom criteria (e.g., automatically emailing purchase orders upon approval).

Best Practices for Smart Rules:

- Clarity is Key: Clearly define conditions and actions to avoid unintended consequences.

- Thorough Testing: Test Smart Rules rigorously in a non-production environment before deploying them.

- Start Simple: Begin with basic rules and gradually increase complexity as your comfort level grows.

Tip#6 Connecting Intacct to Your Ecosystem

Creating a connected financial ecosystem is crucial in today’s data-driven business landscape. Sage Intacct allows you to seamlessly connect with various third-party applications. This eliminates data silos, fosters efficient data flow, and provides a holistic view of your financial health.

Sage Intacct integrates with a vast array of applications catering to diverse business needs:

- CRM Integration (e.g., Salesforce): Eliminate duplicate data entry by syncing customer data between your CRM and Sage Intacct. This ensures accurate invoicing and streamlines billing processes.

- E-commerce Integration (e.g., Shopify): Automate sales data flow from your online store to Sage Intacct. This streamlines order processing, inventory management, and revenue recognition.

- Payroll Integration (e.g., ADP): Simplify expense management and ensure accurate financial reporting by seamlessly integrating payroll data into Sage Intacct.

- Business Intelligence (BI) Tools (e.g., Tableau): Take your financial analysis to the next level. Integrate Sage Intacct data with BI tools to enhance data visualization and generate insightful reports for data-driven decision-making.

The Sage Marketplace offers a wealth of pre-built connectors that simplify integration with popular applications. These connectors eliminate the need for complex custom development, ensuring a smooth and efficient integration process.

Tip#7 IntegrateSage Intacct with Business Intelligence Tools

For the most advanced data analysis and visualization capabilities, consider integrating Sage Intacct with Business Intelligence (BI) tools. These tools elevate your financial analysis by:

- Creating interactive dashboards for real-time data monitoring.

- Conducting complex data analysis to uncover hidden trends and patterns.

- Generating visually compelling reports for clear and impactful communication of financial insights.

By leveraging Sage Intacct’s advanced reporting features and exploring BI integrations, you can transform your financial data from mere numbers into a compelling story that guides your business toward strategic growth.

Tip#8 Advanced Reporting and Data Analysis

Sage Intacct empowers you to go beyond basic financial reporting with its robust suite of advanced features. These tools transform raw data into actionable insights, fueling informed decision-making.

- Drill-Down Functionality: Seamlessly drill down into specific data points within reports for a granular view. For instance, analyze individual line items in a sales report to identify top-selling products or underperforming regions.

- Customizable Reports: Craft reports tailored to your specific needs. Apply filters to focus on specific departments, timeframes, or project data. Additionally, customize report layouts to display information in a way that best suits your analysis requirements.

- Data Export Capabilities: Gain flexibility for further exploration. Export report data into various formats like Excel or CSV. Leverage external tools for deeper analysis, create charts for visual representation, or manipulate data for more comprehensive insights.

- Scheduled Report Delivery: Automate report generation and delivery. Schedule key reports to be delivered to designated users or departments at regular intervals, fostering a data-driven culture within your organization.

While Sage Intacct offers a vast array of customization and integration options, complex scenarios might require specialized expertise. This is where partnering with a Sage Intacct implementation partner like Microsys becomes invaluable. Our Sage consultants possess in-depth knowledge and experience to navigate complex integration projects. We ensure a smooth and efficient implementation process. As a leading managed IT service provider in Toronto, Ottawa, Ajax, and various other regions in Canada, we provide ongoing support to ensure you continue to get the most out of your Sage Intacct investment.