As your business flourishes and financial complexities grow, QuickBooks, a popular accounting solution for startups and smaller businesses, may no longer be sufficient. Migrating to Sage Intacct, a robust cloud-based financial management software, becomes a strategic step towards ensuring long-term financial health and operational efficiency.

This comprehensive guide will equip you with the knowledge to navigate a smooth and successful transition from QuickBooks to Sage Intacct with the help of our professional Sage Consultants.

Why Migrating To Sage Intacct Is The Need Of The Hour

Several factors can prompt businesses to migrate from QuickBooks to Sage Intacct. QuickBooks, while user-friendly, has limitations. Its functionality is primarily designed for basic accounting needs, and it can struggle to handle the demands of a growing business.

Here’s a breakdown of the limitations and how Sage Intacct addresses them:

- Limited Scalability: QuickBooks often struggles with complex financial structures. Sage Intacct’s scalable architecture can accommodate multiple entities, currencies, and intricate reporting needs.

- Data Integrity Concerns: QuickBooks can be prone to data limitations and integrity issues. Sage Intacct offers a robust platform with enhanced security measures and real-time data access.

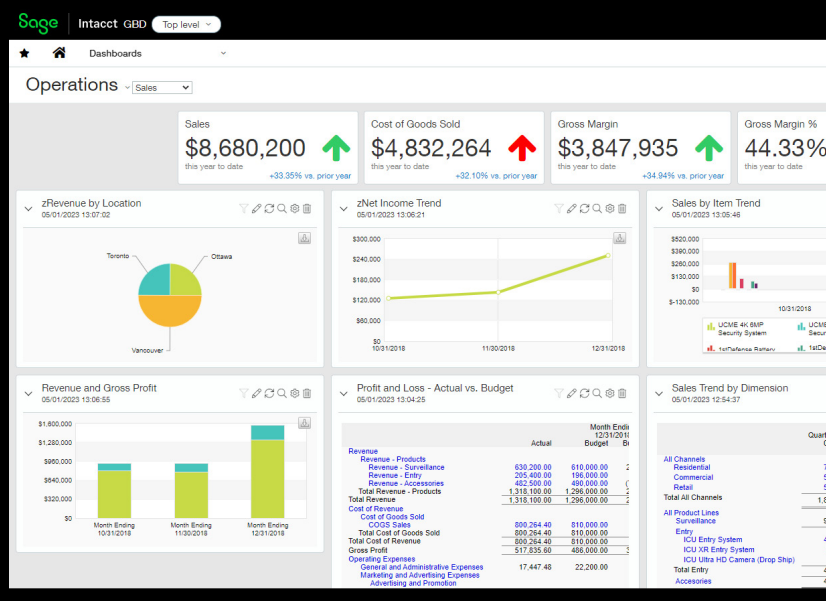

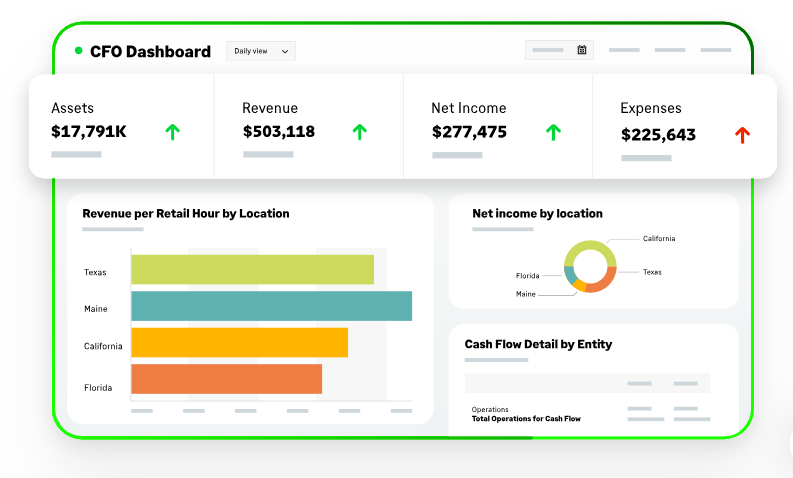

- Limited Reporting Capabilities: QuickBooks reporting features may not provide the depth of analysis required for strategic decision-making. Sage Intacct’s advanced reporting tools offer multi-dimensional insights and real-time data visualization.

- Integration Challenges: Integrating QuickBooks with other business applications can be complex. Sage Intacct boasts a robust open API, enabling seamless integration with various business solutions like CRM and ERP systems.

Partnering for Success

Migrating to Sage Intacct can be a complex process. Partnering with a qualified Sage Consultant or Managed IT Services Provider specializing in Sage solutions can be invaluable. These experts can assess your specific needs, develop a customized migration plan, and ensure a smooth transition with minimal disruption to your daily operations.

Read also: https://microsysinc.ca/when-to-replace-quickbooks-with-sage-intacct-or-sage-300-erp/

In the following sections, we’ll delve deeper into the migration process, explore the key benefits of Sage Intacct, and provide valuable resources to facilitate a successful transition.

Assessing Your Current System

Before embarking on your migration journey to Sage Intacct, a thorough evaluation of your existing QuickBooks setup is crucial. This assessment helps determine the scope of the project, identify potential roadblocks, and ensure a smooth data transfer.

Here are the steps to take:

- Review Your Chart of Accounts: Analyze your current chart of accounts in QuickBooks. Consider if it aligns with your future financial needs and reporting requirements. Complexities like multiple entities or currencies might necessitate modifications.

- Evaluate Data Integrity: Assess the accuracy and completeness of your data in QuickBooks. Look for inconsistencies, duplicate entries, or missing information. Cleaning and organizing your data upfront will minimize errors during the migration process.

- Identify Customizations: If you have customized functionalities or reports in QuickBooks, document them thoroughly. A Sage Consultant can then evaluate if these customizations can be replicated within Sage Intacct or if alternative solutions are required.

- Analyze Integrations: Review any third-party applications currently integrated with QuickBooks. Research their compatibility with Sage Intacct. Some integrations might require reconfiguration or replacement with Sage Intacct Marketplace solutions.

- Gather User Input: Involve key personnel from your finance team in the assessment process. Gain their insights into current workflows and potential challenges they might face with a new system. This user feedback is invaluable when planning training and change management strategies.

By performing this comprehensive assessment, you’ll gain a clear understanding of your existing financial data landscape. This knowledge will empower you to make informed decisions about data migration, identify potential customizations needed in Sage Intacct, and establish a realistic timeline for the transition.

Migrating To Sage Intacct With A Plan In Place

Migrating to Sage Intacct is a strategic move that requires careful planning and execution. Here are key steps to ensure a smooth and successful transition:

Setting Clear Objectives

The first step in planning your migration is establishing clear objectives for the process. What do you hope to achieve by migrating to Sage Intacct? Here are some common goals:

- Enhanced Scalability: Outline your expectations for handling complex financial structures, multiple entities, and intricate reporting needs.

- Improved Data Integrity: Define your desired level of data security, accuracy, and real-time accessibility within Sage Intacct.

- Advanced Reporting Capabilities: Determine the specific reporting features and functionalities you require for strategic decision-making.

- Seamless Integration: Identify which business applications you need to integrate with Sage Intacct and define the required level of data flow.

Clearly defined objectives will guide the entire migration process. They allow you to select the appropriate data to migrate, determine the necessary customizations for Sage Intacct, and measure the success of the migration after completion.

Creating a Timeline

Once you have established your goals, develop a realistic timeline for the migration process. Consider the complexity of your data, the need for customization, and the resources available. A well-defined timeline should include key milestones such as:

- Data Extraction and Cleansing: Allocate time to extract your data from QuickBooks and ensure its accuracy and completeness.

- System Configuration: Schedule time to configure Sage Intacct to meet your specific needs, including a chart of accounts setup and user permissions.

- Data Migration and Testing: Plan for the actual data transfer process and dedicate time for thorough testing to ensure data integrity in Sage Intacct.

- User Training and Go-Live: Schedule comprehensive training sessions for your finance team on using Sage Intacct effectively. Plan a smooth transition to the new system with minimal disruption to your daily operations.

Breaking down the migration process into achievable milestones keeps the project on track and ensures a well-coordinated transition.

Allocating Resources

Migrating to Sage Intacct requires the dedication and expertise of various team members.

- Internal IT Team: Involve your IT team in the planning process to understand the technical aspects of the migration and ensure seamless integration with existing IT infrastructure.

- Finance Team: Engage your finance team throughout the process. Their knowledge of your current QuickBooks setup and financial workflows will be invaluable during data extraction, customization planning, and user training.

- Sage Consultant and a Managed IT Services Provider: Consider partnering with a qualified Sage Consultant or Managed IT Services Provider specializing in Sage solutions. Their expertise can bridge any knowledge gaps within your internal team, ensure optimal configuration of Sage Intacct, and provide ongoing support throughout the migration and beyond.

By carefully evaluating your current system, setting clear objectives, creating a detailed timeline, and allocating the necessary resources, you can ensure a smooth and successful migration to Sage Intacct. This well-planned transition will empower your business to leverage the robust functionalities of Sage Intacct and achieve long-term financial growth.

Executing the Migration

With a comprehensive plan in place, it’s time to execute the migration to Sage Intacct. This phase involves meticulous data preparation, a well-defined migration process, and rigorous testing to ensure a seamless transition.

Data Preparation

The success of migrating to Sage Intacct hinges on the quality of your data. Here’s how to ensure your data is clean and organized for migration:

- Data Cleansing: Identify and eliminate any inconsistencies, duplicate entries, or missing information from your QuickBooks data. This might involve reconciling accounts, correcting errors, and standardizing data formats.

- Data Mapping: Create a detailed map that defines how your existing QuickBooks data will be translated and structured within Sage Intacct. This mapping ensures your financial information remains consistent and readily accessible after the migration.

- Data Archiving: Determine which historical data from QuickBooks is no longer required for day-to-day operations. Consider archiving inactive accounts or older data sets to minimize the amount of information being migrated and optimize storage space in Sage Intacct.

A Sage Consultant or Managed IT Services Provider can be invaluable during data preparation. Their expertise can help identify potential data quality issues, recommend best practices for data cleansing and mapping, and ensure your data is appropriately structured for a smooth transition to Sage Intacct.

Migration Process

Once your data is clean and organized, the actual migration from QuickBooks to Sage Intacct can commence. Here’s a simplified step-by-step guide:

- Data Extraction: Utilize data migration tools or work with your Sage Consultant to extract your financial data from QuickBooks. This extracted data will serve as the foundation for your new Sage Intacct system.

- Data Transformation: The extracted data might require some transformation to align with the structure and format of Sage Intacct. This may involve mapping account codes, converting data types, or defining custom fields within Sage Intacct.

- Data Loading: The transformed data is then loaded into your new Sage Intacct system. This process should be carefully monitored to ensure data integrity and identify any potential errors during the transfer.

- System Configuration: While your data is being migrated, finalize the configuration of your Sage Intacct system. This includes setting up your chart of accounts, defining user permissions, and customizing reports to meet your specific needs.

Testing and Validation

Once the data migration is complete, rigorous testing is crucial before transitioning to Sage Intacct. Here’s how to ensure your data is accurate and complete:

- Data Validation: Compare the migrated data in Sage Intacct with the original data in QuickBooks. Verify the accuracy of balances, transactions, and account details to ensure a flawless transfer.

- Scenario Testing: Simulate real-world financial processes within Sage Intacct to test functionalities and identify any discrepancies. This testing helps uncover any potential issues before transitioning your team to the new system.

- User Acceptance Testing (UAT): Involve key users from your finance team in testing the new Sage Intacct system. Their feedback on user interface, functionality, and reporting capabilities is invaluable for identifying areas for improvement before full deployment.

By devoting sufficient time and resources to data preparation, following a well-defined migration process, and conducting thorough testing, you can minimize risks and ensure a successful transition to Sage Intacct. Consider partnering with a Sage Consultant or Managed IT Services Provider for their expertise in data migration best practices and Sage Intacct system configuration. Their guidance can ensure a smooth and efficient execution phase, paving the way for a successful migration to your new financial management platform.

Challenges and Considerations When Migrating To Sage Intacct

Migrating to Sage Intacct, while advantageous, isn’t without its challenges. Here are some common hurdles to consider:

- Data Quality Issues: Inconsistent or inaccurate data in QuickBooks can lead to errors during migration. Investing time in data cleansing upfront minimizes these risks.

- Process Disruptions: Transitioning to a new system can temporarily disrupt daily workflows. Effective training and change management strategies are crucial to ensure smooth user adoption of Sage Intacct.

- Customization Needs: Your existing QuickBooks setup might require customizations within Sage Intacct to replicate functionalities. A clear understanding of your needs and partnering with a Sage Consultant can help achieve a seamless transition.

Tips for Overcoming Obstacles

- Thorough Planning: A well-defined migration plan with clear objectives and timelines helps anticipate challenges and develop solutions.

- Data Cleansing Efforts: Dedicate time and resources to cleaning and organizing your QuickBooks data before migration.

- User Training and Support: Provide comprehensive training for your finance team on using Sage Intacct effectively. Ongoing support ensures a smooth user adoption and minimizes disruptions.

Importance of Sage Consultants

Migrating to a robust financial management platform like Sage Intacct requires expertise and careful planning. Partnering with a Sage Consultant from a Managed IT Services Provider like Microsys can significantly enhance your migration success.

Sage Consultants possess in-depth knowledge of both QuickBooks and Sage Intacct. They can guide you through every stage of the migration process, from data assessment and planning to execution and post-migration support. Their expertise helps:

- Minimize Risks: They can identify potential data quality issues and recommend best practices for data cleansing and migration.

- Optimize Configuration: They ensure your Sage Intacct system is configured to meet your specific needs and reporting requirements.

- Streamline the Process: Their experience ensures a smooth and efficient migration, minimizing disruptions to your daily operations.

Considering migrating to Sage Intacct? Don’t navigate the complexities of migrating from QuickBooks to Sage Intacct alone. Contact Microsys today.

We’re a Managed IT Services Provider with experienced Sage Consultants who are here to help businesses of all sizes achieve a seamless transition to a more powerful financial management solution. You can also schedule a consultation to learn about our Cyber Security Services, HRMS – Human Resource Management System, and more.